Sustainable Investment Concept

Fullgoal’s investment philosophy has always been highly aligned with the concept of sustainable investment. The company strives to deliver long-term sustainable investment returns through in-depth research and bottom-up stock selection. Under this guiding principle, the company's sustainable investment concept is to find the optimal balance between social value and commercial value. This is because conventional evaluation systems tend to merely focus on assessing the social value created by companies. However, in situations where corporate resources are limited, excessive emphasis on social value creation may sacrifice commercial value and result in underperformance of stock prices. Therefore, in recent years, Fullgoal has been committed to establishing a distinctive sustainable investment evaluation system that combines the conventional system, which reflects the stocks’ social value, with Fullgoal's research and investment system that reflects stocks’ commercial value. It assesses the social and commercial value of individual stocks separately and then applies internally developed risk indicators to perform negative screening. By using quantitative indicators to exclude companies that excessively sacrifice commercial value for the sake of maximizing social value, as well as companies that disregard social value in pursuit of excessive commercial value, the company seeks enterprises that achieve the "greatest common denominator" in creating both social value and business value.

Source:Fullgoal Fund,data as of Dec 31,2024.

Sustainable investment business objectives

After years of practice, Fullgoal Fund has established a balanced development of equity, bond and quantitative investment. Under the guidance of the sustainable investment strategy, each investment segment has set sustainable investment business objectives, and the Sustainable Investment Committee of the company, as the highest authority, guides the orderly development of sustainable investment business in various investment business sectors.

Source:Fullgoal Fund,data as of Dec 31,2024.

Number of funds

Fund size

Awards

At the investment business level, the three segments have organically integrated sustainable investment principles into their respective research and management frameworks.

At the product level, the company is committed to enhancing its portfolio of sustainable investment products, issuing 16 products with total assets over USD 2 billion, and has received a cumulative total of 13 honors and awards.

At the risk management level, since 2019, the company has incorporated sustainable investment risks into its overall equity risk monitoring system.

Sustainable Investment

Practice

Carrying the attributes of inclusive finance and social responsibility, Fullgoal firmly believes that by consistently safeguarding the interests of shareholders, the company can grow stronger and better contribute to society. The company integrates social responsibility into every detail, making it an inseparable part of Fullgoal’s core value, and strive for harmonious and sustainable development. Simultaneously, the company actively implements the concept of sustainable investment through concrete actions in its investment business, aiming to guide and promote the sustainable development of listed companies and contribute to the establishment of a sustainable investment system with Chinese characteristics.

Sustainable investment strategy plays a significant role in Fullgoal's overall strategy, and the concept of sustainable development has deeply ingrained itself in the corporate culture. The company has undertaken various practices in the areas of environmental, social, and governance.

Environmental

In 2012, the company established the Shanghai Fullgoal Environmental Protection Foundation, which was the first environmental public foundation in China's fund industry. The foundation advocates the environmental concept of "Reducing for a better life" and is dedicated to funding low-carbon activities, supporting various environmental initiatives, and other charitable projects. It embodies Fullgoal’s compassion and responsibility towards society and has become an important platform for the company to convey its love and care.

The foundation not only actively contributes in terms of material donations but also places great emphasis on the effectiveness and sustainable development of its public welfare projects. This includes initiatives like the "Love Health - Clean Water Campaign," which addresses the issue of safe drinking water in remote areas for students in China, and the "Love Transmission - Computer Classroom Initiative," which provides well-performing recycled computers to underprivileged rural schools for the establishment of computer classrooms.

Social

Fullgoal takes its social responsibility in a multi-dimensional manner, including poverty alleviation, social contributions, investor education, and employee care.

Poverty Alleviation

Fullgoal Fund actively engages in poverty alleviation initiatives, providing targeted support to Huaxi Village in Chongming, Shanghai, and Fenxi County in Shanxi Province. For two consecutive years, we have participated in several poverty alleviation projects in Xinghe County, led by the Social Security Fund Foundation, to contribute meaningfully to the fight against poverty.

Social Contribution

In 2022, Fullgoal partnered with Shanghai University of Finance and Economics to establish the "Shanghai University of Finance and Economics Fullgoal ESG Research Institute." This institute consolidates research resources from both the university and external partners, continuously studying critical sustainability issues and promoting the practical application of sustainable investment while supporting talent development and social services.

Investor Education

Since 2002, the company has hosted investor education events under the "Fullgoal Forum," which takes place biennially, with ten events held to date. Additionally, we actively participate in investor education activities organized by regulatory bodies, including the CSRC, stock exchanges, and industry associations.

Additionally, Fullgoal is a strong advocate for inclusion and diversity. We are proud to report that women currently represent 44% of our workforce in Shanghai headquarter, with 50% of senior management positions held by women, and 61% of female employees in Fullgoal Hong Kong . This commitment places us at the forefront of our industry in promoting gender diversity.

Corporate governance

The equity structure of Fullgoal Fund has remained unchanged for 20 years, and the balanced and stable equity structure has formed a good communication and coordination mechanism among shareholders, fully empowering the management and maintaining the company's independent operation with performance as the guide. At the same time, the company's core team is very stable, with four senior executives aged over 20 years, an average age of 16 years, and an average age of 17 years for the core investment management team.

As a wholly-owned subsidiary of Fullgoal Fund, Fullgoal Hong Kong operates in an integrated manner with its parent company, and the culture of Fullgoal is inherited from its parent company. The board of directors of the company is concurrently served by management personnel from various lines of the parent company, and the company's responsible personnel have not changed since its establishment.

In the capacity building of rich countries, Mr. Chen Ge, the general manager, has led the creation of "three driving horses": core investment capacity building, risk management capacity building, and customer service capacity building. In his eyes, just as the business board interests, fixed income, and quantitative investment "three driving horses" advance side by side, the "three driving horses" of capacity building must also advance side by side. Similarly, Chen Ge also clearly defined a long-term thinking for capacity building: focusing on "quality" rather than "quantity", daring to use time to exchange space, and ultimately forming a benign and spiral rising model between capacity and scale.

Sustainable Investment Organizational Structure

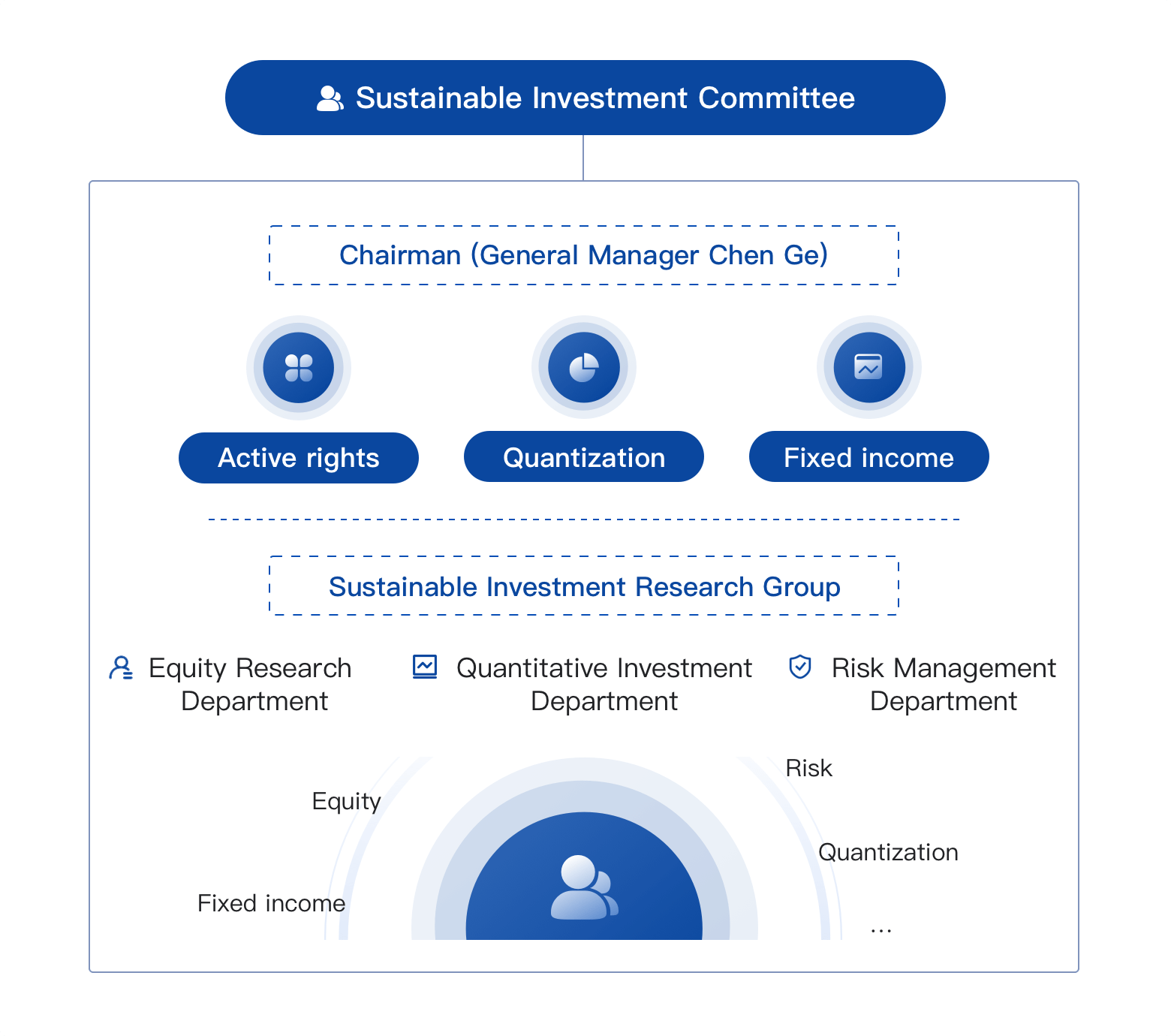

Fullgoal adapts a dual management model of "leadership team + working group".

Firstly, the company has established a Sustainable Investment Committee, which is responsible for formulating strategies and decisions related to sustainable investment. The Chairman of the committee is Company CEO Mr. Chen Ge, and the members include key leaders from the three major business areas: active equities, quantitative investment, and fixed income.

Secondly, under the Sustainable Investment Committee, the company has formed a cross-departmental Sustainable Investment Research Group to ensure the concrete implementation of sustainable investment strategies. The group is led by the heads and deputy heads of the Equity Research Department, Quantitative Investment Department, and Risk Management Department, with memberships involving the key personnel from various departments.

Sustainable Investment Concept

Sustainable Investment Concept Sustainable investment business objectives

Sustainable investment business objectives Sustainable investment strategy

Sustainable investment strategy Sustainable investment organizational structure

Sustainable investment organizational structure UNPRI

UNPRI

Address : 27-30&38F, Century Link Tower 2, No.1196 Century Avenue, Pudong New District, Shanghai

Address : 27-30&38F, Century Link Tower 2, No.1196 Century Avenue, Pudong New District, Shanghai Email : public@fullgoal.com.cn

Email : public@fullgoal.com.cn Fax : 021-20513277

Fax : 021-20513277 Hotline :

Hotline :